Residential and Agricultural Properties

You may reduce your WQPC amount. Use the WQPC forms to

- apply for a credit or hardship reduction

- submit an appeal

- request to combine accounts for adjoining properties

Applications, submissions, and requests are due September 30.

The WQPC is determined with this formula

Water Quality Protection Charge for a property = (Total square feet of impervious area / ERU) * Rate

See rate, tier, and impervious surface details.

Properties are put into tiers based on how much impervious surface is on the property.

Most residential property owners will pay $147.00 or less.

See the WQPC calculation for your property. This includes the aerial image used to determine your charge.

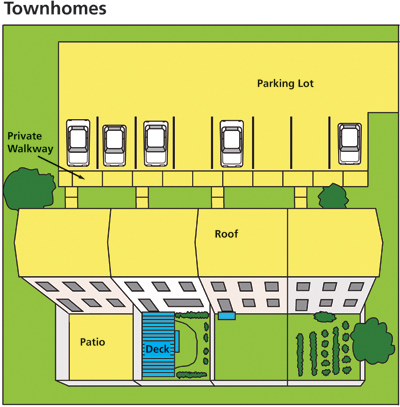

Impervious surface for an individual townhome may include shared and private areas

To determine the WQPC for an individual townhome:

- Add up the total shared impervious surface area between all connected properties. This includes building area, communal parking lots, community pools, etc. The total shared surface area is called the “footprint”.

- Divide the “footprint” by the number of connected properties. The result is your property’s share of the WQPC.

- If your property has any private areas not shared with other townhomes (private areas can include a backyard patio or a basketball court): Add the impervious surface area of these private spaces to your WQPC calculation.

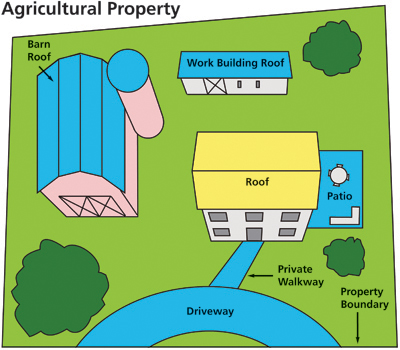

Impervious surface for agricultural properties has more exceptions

The impervious surface area of an agricultural property is only based on the residence. See additional agricultural property surfaces that are not included in the WQPC.

WQPC calculation examples

Detached home - Calculation example

Mei owns property with a detached house in Montgomery County. Her house has 2,000 square feet of roof surface area. She also has a detached garage with 300 square feet of roof surface area and a driveway of 200 square feet.

The total impervious surface area of Mei’s property is: 2,000 + 300 + 200 = 2,500 square feet

Based on the WQPC tier table, Mei’s property falls in Tier 3. She would be charged at the Tier 3 level of $147.00.

Townhome - Calculation example

Alissa and Andy own a townhome that is one of four in a row of houses. The total roof surface area of all four townhomes is 4,000 square feet and the communal parking area is 2,000 square feet. Alissa and Andy also have a private patio of 400 square feet.

The communal impervious surface area for the row of townhomes (the footprint) is: 4,000 + 2,000 = 6,000 square feet

Divide the “footprint” by the number of properties: 6,000/4 = 1,500 square feet

Alissa and Andy also have the 400 square feet of private patio, making the total impervious surface area of their property: 1,500 + 400 = 1,900 square feet

1,900 square feet falls in Tier 3. Therefore, Alissa and Andy would be charged $147.00.

Agricultural property - Calculation example

Zach owns an agricultural business with his personal residence also on the property. The house has 3,000 square feet of roof surface area, 1,000 square feet of driveway and a patio around a pool totaling 800 square feet.

Zach’s agricultural business has a barn, work area, silo and shed totaling 5,000 square feet of impervious surface area.

Zach’s property would be charged based on his residence and not the agricultural structures used for his business or the 1,800 square feet of patio and driveway.

The total impervious surface area for the residence is 3,000 square feet. Zach's property falls in Tier 3, and therefore, he would be charged $147.00.

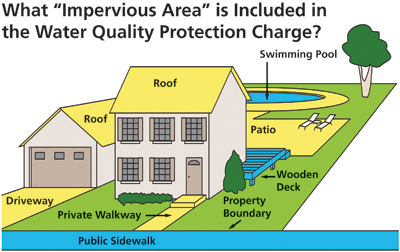

Property examples

You may reduce your charge

Stormwater Management Credit

Account information you need for your credit application

County regulations require property owners to renew the WQPC credit every 3 years.

- Account ID as it appears on the property tax bill (8 digit number)

- Check if this is a “new” or a “renewal” application.

- Owner Name as it appears on your property tax bill.

- Property Address, City, State, and Zip Code of the physical location of the property with an on-site Stormwater Management System.

- Mailing Address, City, State, and Zip Code if different than site address. This is needed to send correspondence regarding credit application.

- Telephone Number to contact property owner regarding credit application and coordination of site visit.

- E-mail address to provide to contact property owner regarding credit application (include renewal reminder) and coordination of site visit.

See the Water Quality Protection Charge Credit Procedures Manual (PDF).

Credits of up to 80% off the Water Quality Protection Charge are available to property owners who own and maintain on-site stormwater management practices in accordance with the maintenance requirements of the Montgomery County Department of Environmental Protection.

The credit is based on the volume of water captured.

Stormwater management practices are landscaping techniques or structures that help reduce stormwater runoff, prevent stream damage and flooding and erosion.

Types of stormwater management practices eligible for credit include:

Do you have a stormwater management practice on your property?

Yes, my practice is registered with the County!

You can apply for a credit. A credit is a reduction off your annual WQPC.

The property owner must maintain stormwater management practices in accordance with the maintenance requirements of the Department of Environmental Protection (DEP).

No, but I want to.

The RainScapes program works with property owners to install stormwater management practices like rain gardens, conservation landscaping and green roofs. You could even receive financial incentives!

I'm not sure.

Your property may have practices that were installed by a previous owner or during construction. If you have a garden on your property, it might be a RainScape.

Search your address to see if you already have a practice registered with the County.

Search our map to see if your residential or agricultural property has stormwater management facilities registered with the County.

Hardship Reduction

A hardship exemption allows a property owner a reduced charge due to financial limitations.

To qualify for an exemption

- your household income must not exceed 170% of the Federal poverty level, or

- you must be approved for benefits under the Maryland Energy Assistance Program for the current billing year.

See the U.S. Federal Poverty Guidelines.

Appeals and Contiguous Single Owner Properties

Information you need for your appeal

When appealing, the property owner must provide:

- A detailed statement of the basis for the petition, and

- Documents supporting

- the assertion that the property should be assigned a different classification; or

- that the impervious area measurements used to calculate the equivalent residential units for the property are incorrect; or

- that the property is not subject the WQPC under the applicable law.

Appeals

If a property owner believes that the WQPC was assigned or calculated incorrectly, they may petition the Director of the Department of Environmental Protection for an adjustment by submitting a written request, using the appeal form.

Within 60 days after receiving the appeal petition, the Director will

- review the WQPC assigned to the property and

- make a written determination of whether the property owner's request for an adjustment of the charge should be granted or denied.

Requests to combine adjoining properties

Property owners can apply for combining contiguous single-owner property accounts into one. Contiguous properties have no separation, such as a road, between properties.

If the property spans multiple tax accounts, you can appeal to have the separate accounts combined into one for the purposes of calculating the WQPC.

Petition the Director of the Department of Environmental Protection for an adjustment by submitting a written request, using the online appeals form.