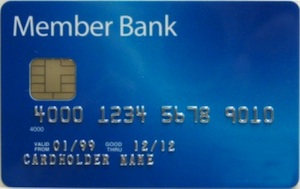

Chip Cards

New “Chip” Credit Card Technology

Beginning in October 2015, the U.S. credit card industry is transitioning to credit cards with computer microchips moving away from the traditional magnetic strips. Credit and debit card users will now dip, instead of swipe.

You may hear people referring to these cards by different names:

- Chip card,

- Smart card, or

- E-M-V card (Europay, Master Card, Visa card).

Using a chip card will be just a little different for consumers. At checkout, instead of swiping the card along the side of the terminal, consumers will ‘dip’ or insert the chip end of the card into a slot at the bottom of the terminal and leave the card until the transaction is completed. Some retailers may not have the chip reader activated and the card may still need to be swiped.

The card industry has adopted chip technology to improve security and prevent counterfeit fraud. Unlike traditional credit cards that use a magnetic strip, these new cards create a unique transaction code for each transaction. The code is always changing making it difficult for a thief to steal and use it. Signing or entering a PIN will still be used as a verification mechanism when using the new chip cards.

Consumers will have the same protections offered by traditional credit and debit cards. To learn more about credit card basics, visit our webpage at Credit Card Basics.

Scammers are taking advantage of the transition to chip cards and using it as an opportunity to trick consumers into revealing personal information. Be wary of fake emails pretending to be from credit card issuers telling people they need to update their account by sending a response confirming personal information or clicking on a link to get an upgraded card.

Scammers then use the provided information to steal a consumer’s identity or they could install a virus or malware if a consumer clicks on a link.

Do not trust email links especially when you did not initiate contact. You should only provide personal information through the company’s known website that you typed yourself.