Development Impact Taxes

Development Impact Taxes are, set by the Montgomery County Council, assessed on new residential and commercial buildings and additions to commercial buildings in the county to fund, in part, the improvements necessary to increase the transportation or public-school systems capacity, thereby allowing development to proceed.

In addition to Impact Taxes your development may be assessed a Local Area Transportation Improvement Policy fee (LATIP).

The Department of Permitting Services is charged with collection of Development Impact Taxes.

If you apply for a building permit for new residential development (single –family detached, single-family attached, multifamily, high-rise, multifamily senior) you will be assessed the Transportation and the School Impact taxes at the current rates.

If you demolish a residential dwelling you may be entitled to a waiver of the impact taxes if you rebuild a residential dwelling on the same site. Construction of the new dwelling must begin within one year of demolition.

If you apply for a building permit for new commercial development (new building or addition) you will be assessed the Transportation Impact taxes at the current rates.

The applicable rate is determined by the use category of construction (office, industrial, retail, place of worship, etc.).

If you demolish a commercial building you may be entitled to a reduction or waiver of the impact tax if you rebuild a new commercial building on the same site. Reductions and waivers are based on the square footage demolished and the square footage of new construction. Construction of the new building must begin within one year of demolition.

A property owner may receive an Impact Tax credit if the owner enters into a participation agreement to provide additional transportation or school capacity. A property owner may also receive a credit if they are required, through the development approval process, to build or contribute to transportation or school improvements that provided additional capacity. The Department of Transportation must calculate the credit.

Impact taxes are not imposed on any Moderately Priced Dwelling (MPDU) or Workforce Housing units (WHU). If your development has at least 25% MPDU’s or WHU’s your entire project may be exempted from impact taxes.

Impact taxes may be deferred for six (6) months for after a residential permit issued or twelve (12) months after a commercial permit is issued. In either case the taxes must be paid before a final inspection can be performed.

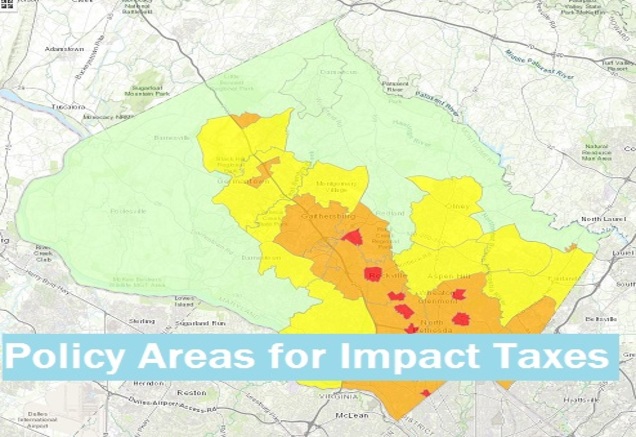

Please see the policy area map to determine your policy area.

Transportation

Transportation impact development taxes are assessed on residential and commercial projects.

Schools

School development impact taxes are assessed only on residential projects.

UTILIZATION PREMIUM PAYMENTS

Utilization Premium Payments for public school Improvements are determined by the Maryland-National Capital Park and Planning Commission (M-NCPPC) at the time of plan approval for subdivisions.Local Area Transportation Improvement Policy

LATIP assessment is determined by the Maryland National Capital Park and Planning Commission (MNCPPC) at the time of preliminary plan approval for subdivisions that were approved under the Local Area Transportation Review provision in the count Subdivision Staging Policy (SSP). It is currently assessed in the White Oak area.