Prepayment of Montgomery County Real Property Taxes

You may prepay a portion of your Real Property Taxes for the next levy year, by using the following process only.

You may prepay taxes by (1) completing and signing the Notice of Intent, and (2) mailing a check to the Dept. of Finance, Division of Treasury, or by bringing your payment in person to the Dept. of Finance, Division of Treasury. Do not mail your payment to any other address. The only address for mailing Prepayments or for bringing Prepayments in person is:

Department of Finance, Division of Treasury

ATTN: PREPAYMENT OF TAXES

27 Courthouse Square, Suite 200

Rockville, MD 20850

Prepayments in person at the Division of Treasury can be made in the form of cash or check. Payments will be accepted during the hours of 8 a.m. to 4:30 p.m.ATTN: PREPAYMENT OF TAXES

27 Courthouse Square, Suite 200

Rockville, MD 20850

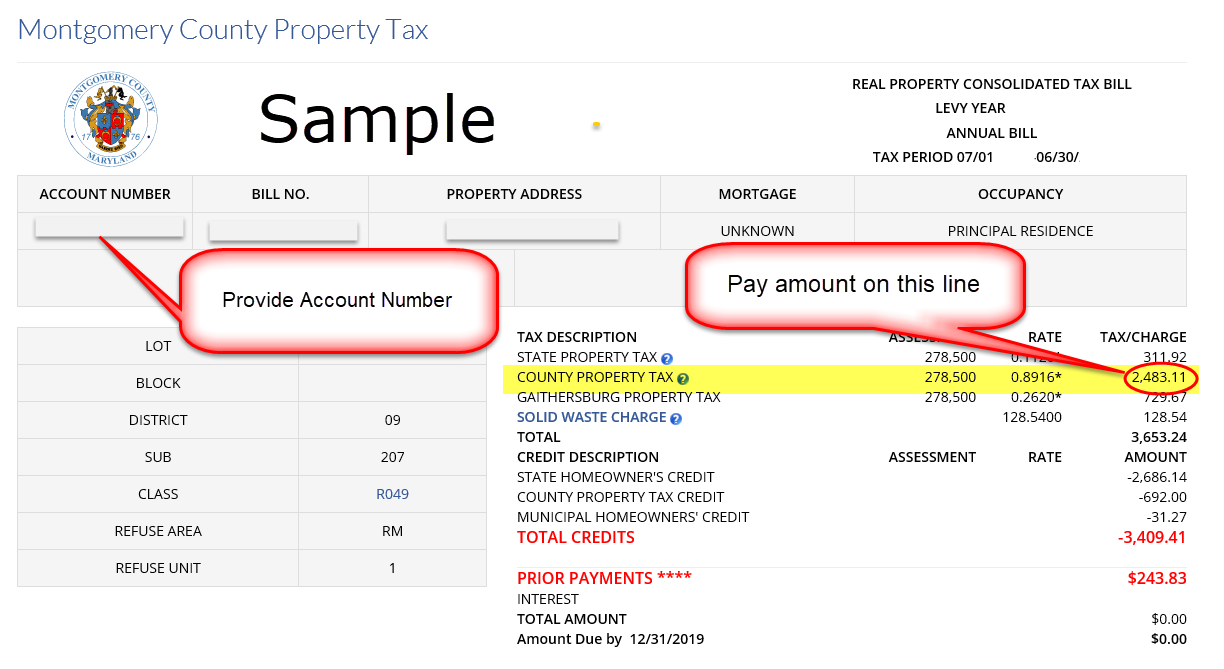

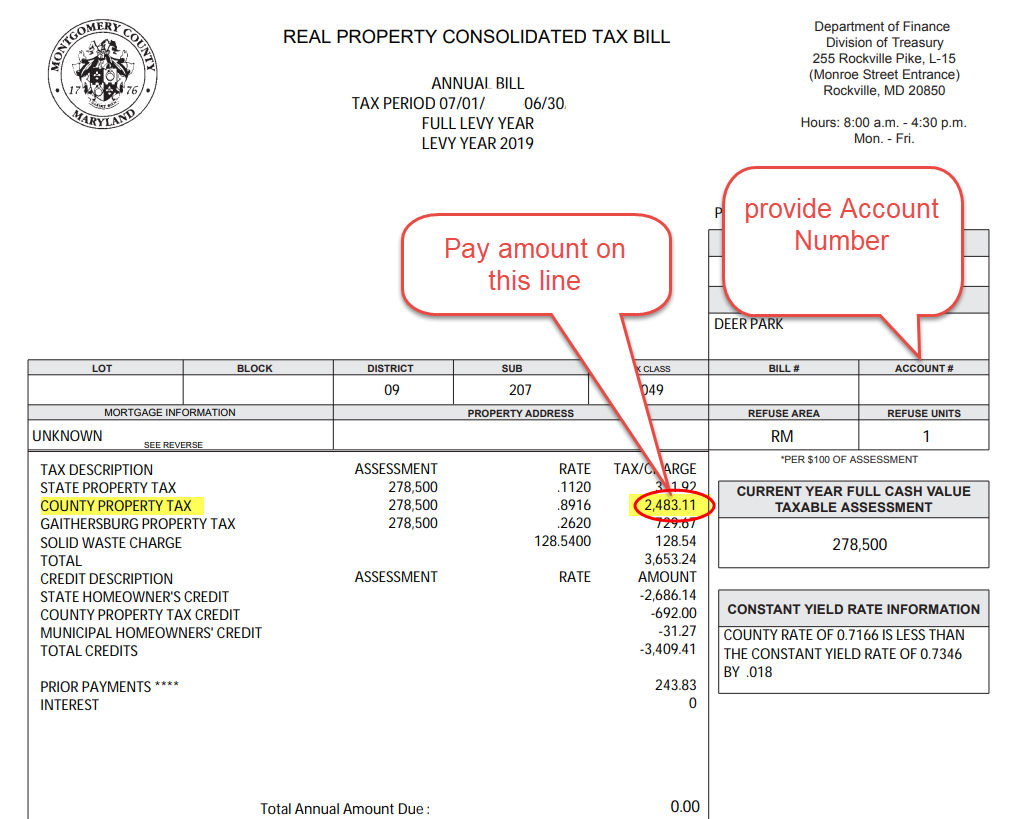

The only amount that you will be allowed to pay is equal to the amount on the current levy year County Real Property Tax that is listed as “County Property Tax.” Do not pay any other amount, or the payment will be rejected. Please see the examples below—the samples show which line to look for to determine the amount that can be paid. When paying in person, bringing with you a copy of your current levy year tax bill will expedite the process, as it shows the County tax amount billed. If you do not have a copy of your current levy year tax bill you can print it out by looking up your property at https://apps.montgomerycountymd.gov/realpropertytax . You must pay ALL amounts due on the current and prior year taxes before prepaying the upcoming year taxes.

There will be no online viewable record of your prepayment of tax until there is a new year tax bill posted and available in the tax system, at which time the prepayment will then be posted to your new year tax bill. Tax bills are usually processed at the beginning of July.

You must sign the Notice of Intent to prepay your next levy year tax bill. Please bring a signed copy of the Notice of Intent to expedite this process. No payments will be accepted without a signed Notice of Intent. The Notice of Intent will also serve as your receipt, if you pay in person at the Division of Treasury.

Payments made in person by any person other than the taxpayer must be accompanied by a letter from the taxpayer authorizing the person to make that payment. The letter authorizing the payment must be signed by the taxpayer, and the taxpayer must print his or her name under his or her signature.

There will be no refunds of prepaid taxes before the prepayment is posted to your next levy year real property tax bill. Refunds will only be given if the prepayment results in an overpayment of the next levy year taxes. Normally tax bills are processed in July, and payments are posted only after the bills are processed. Prepayments of taxes will not be posted until July 1 st of every year, at the earliest.

What follows is a list of the items you need to be aware of to prepay your real property taxes. Montgomery County does not provide tax advice and will not comment on whether these taxes, or any other taxes, are or will be deductible under any Federal, State or County laws.

-

Please mail your check to:

Dept. of Finance, Division of TreasuryYou may also pay in person at the above address, using only checks or cash. Prepayments will be accepted only during normal business hours, Monday through Friday, from 8 a.m. to 4:30 p.m. Please do not send payments to any other address.

ATTN: Prepaid Property Taxes

27 Courthouse Square, Suite 200

Rockville, MD 20850

- Taxpayers must sign a Notice of Intent or prepayment will not be accepted. The Notice of Intent is available here . No other forms of a Notice of Intent will be accepted.

- Payments must be made by check or cash. No other form of payment will be accepted.

- The Notice of Intent requires that you agree to the following:

- That you intend to prepay the upcoming levy Year County real property tax on the above described property as authorized under Section 52-2A of the Montgomery County Code. Your prepayment must equal exactly the amount from the “County Property Tax” line on the current Levy Year tax bill—you may not modify this amount in any way (for example, by deducting any tax credits);

- If you owe any balance on your (or any prior year’s) Real Property Consolidated Tax Bill, your prepayment of the new upcoming levy year for County real property tax will be used instead to pay the balance due. If your prepayment exceeds any prior year’s balance, the over payment will be returned to you unless the over payment equals exactly the amount of County property tax owed for the immediate prior year Levy, in which case the prepayment will be treated as a prepayment of your new/upcoming County property tax as authorized under Section 52-2A;

- That your prepayment of the new upcoming levy year taxes is limited to the amount shown on the “County Property Tax” line on the tax bill for the current year Levy, do not deduct the amount of any tax credits from your payment; do not pay any amount other than the amount on the “County Property Tax” line.

- That your prepayment will be applied to your upcoming levy year Real Property Consolidated Tax Bill, when that tax bill is available in the tax system operated by the County;

- That there will be no refunds until there is a next levy year tax bill for your account and the prepayment of tax is posted to your next levy year tax bill. There will only be a refund if the prepayment results in an over payment of the next levy year Real Property Consolidated Tax Bill for the above described property;

- That the County will not pay any interest on the prepayment, including any interest on any refund attributable to the prepayment;

- THE COUNTY DOES NOT REPRESENT TO YOU THAT THE PREPAYMENT OF YOUR NEW UPCOMING LEVY YEAR COUNTY PROPERTY TAX MAY BE LEGALLY DEDUCTED ON YOUR FEDERAL INCOME TAX RETURN. THE COUNTY ADVISES YOU TO CONSULT WITH YOUR OWN TAX ADVISOR BEFORE DEDUCTING YOUR PREPAYMENT ON YOUR FEDERAL INCOME TAX RETURN;

- That your signed Notice of Intent will be your only receipt;

- That your prepayment will not show up in the tax system until there is a next levy year tax bill for your account, and your prepayment has been posted to your next levy year tax bill;

- That your tax account will be charged an additional non-refundable fee of $35.00 for any check submitted that is returned by a financial institution for any reason, including a stop payment, insufficient funds or closed accounts.