Energy-Efficient Buildings Property Tax Credit

The County’s Energy-Efficient Buildings program is a two-tiered incentive of property tax credits for new and existing energy-efficient commercial and multi-family buildings. Existing building owners can earn up to a 100% property tax credit against County taxes for two years for eligible energy efficiency improvements. Newly constructed building owners can earn up to a 100% property tax credit against County taxes for four years for constructing a new building exceeding current building code requirements.

The County’s Energy-Efficient Buildings program is a two-tiered incentive of property tax credits for new and existing energy-efficient commercial and multi-family buildings. Existing building owners can earn up to a 100% property tax credit against County taxes for two years for eligible energy efficiency improvements. Newly constructed building owners can earn up to a 100% property tax credit against County taxes for four years for constructing a new building exceeding current building code requirements.

Property Tax Credits for Existing Buildings

The County’s Energy-Efficient Buildings program is a two-tiered incentive of property tax credits for energy-efficient commercial and multi-family buildings. It allows existing building owners to receive up to a 100% property tax credit against County taxes for two years following major energy efficiency improvements. To qualify, existing buildings must have:

- At least 10,000 square feet of gross floor area

- Received a Certificate of Occupancy from the Department of Permitting Services

- Achieved at least a minimum 50% occupancy rate for at least 12 consecutive months

- Demonstrated energy improvements consistent with the requirements of Montgomery County Code, Section 52-103A

Tier 1 Credit for Existing Buildings

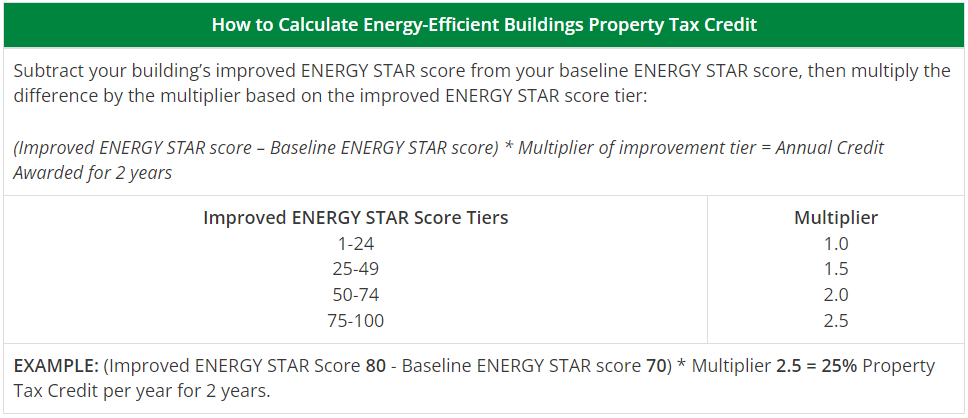

To receive the 1st tier credit, eligible existing building owners must demonstrate a measurable reduction in energy use by setting a 12-month baseline in the ENERGY STAR Portfolio Manager tool, summarizing actions and installations performed to reduce energy use, and measuring improved energy performance using Portfolio Manager. This tax credit allows up to three (3) applications for a single building: one (1) application and two (2) reapplications.

Buildings located in Equity Emphasis Areas receive an additional 10% credit.

Tier 2 Credit for Existing Buildings

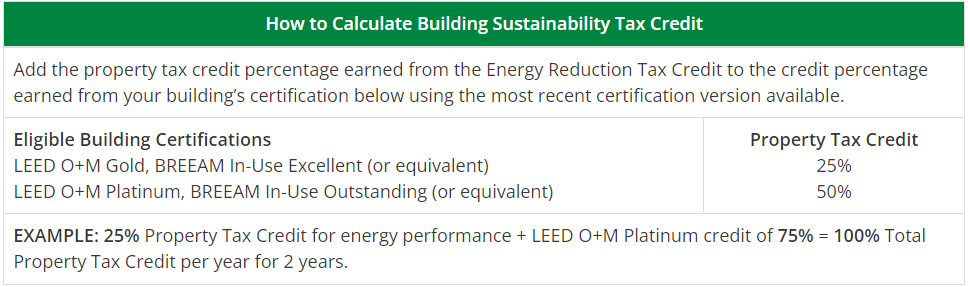

Once the 1st tier credit is met, building owners can apply for an additional tax credit for two years, the Building Sustainability Tax Credit, by receiving a LEED, BREEAM, or equivalent (robust, third party certification systems that strive for net-zero buildings) energy efficiency certification. If both the 1st tier and 2nd tier are achieved, the two credits will be aggregated, but cannot exceed 100% per year.

Additional Definitions and Details about the Energy-Efficient Property Tax Credit for Existing Buildings

Additional Definitions and Details about the Energy-Efficient Property Tax Credit for Existing Buildings

- Energy conservation device means any equipment, device, or material that reduces the demands for conventional fuels or increases the efficiency of these fuels, but is not a standard household appliance.

- Acceptable energy conservation device documentation includes: finalize DPS permit, vendor installation invoices

- Baseline and Improved ENERGY STAR Score 12-month time periods must not:

- overlap

- include the energy conservation device installation period

- be more than 6 calendar years apart

- The Baseline and Improved ENERGY STAR Score 12-month time period must use the same ENERGY STAR score metric reference data.

- The Baseline ENERGY STAR Score 12-month time period must not begin earlier than August 26, 2018.

- Improved ENERGY STAR 12-months cannot have been issued more than 12 months before the application date.

- ENERGY STAR Data Verification Checklists must be verified by an accredited building professional, which are a licensed Professional Engineer (PE) or Registered Architect (RA) that are in good standing.

- For Reapplications:

- The Baseline ENERGY STAR score for reapplication cannot be older than the previous application’s Baseline ENERGY STAR score; However, the reapplication baseline score can overlap with the previous application’s Improved ENERGY STAR baseline.

- Each building is eligible for a maximum of 3 applications – one initial application and two reapplications.

- Note: If the building cannot achieve the ENERGY STAR score, contact the Department of Environmental Protection to discuss using the USGBC alternative compliance path for Energy Use Intensity (EUI). Requests will be considered on a case-by-case basis.

- About the Building Sustainability Tax Credit 2nd Tier Certifications:

- “LEED O+M” means the Leadership in Energy and Environmental Design rating system

- for Building Operations and Maintenance, administered by the USGBC. Only Gold and Platinum certifications are eligible.

- “BREEAM USA In-Use" means the Building Research Establishment Environmental Assessment Method rating system for In-Use Buildings (non-domestic buildings in their operational phase) administered by BRE Global. Final ratings for both Part 1 (Asset Performance) and Part 2 (Management Performance) must be completed to be eligible for the Building Sustainability Tax Credit. Only Excellent or Outstanding Final ratings for BREEAM In-Use (both Part I and Part 2 required) are eligible.

Property Tax Credits for Newly Constructed Buildings

The Energy-Efficient Buildings program is a two-tiered incentive of property tax credits for new energy-efficient commercial and multi-family buildings. It allows newly constructed building owners to receive up to a 100% property tax credit against County taxes for four years for constructing a new building exceeding current building code requirements with no annual cap. To qualify, newly constructed buildings must have (or will have):

- At least 10,000 square feet of gross floor area

- a certification from the Department of Permitting Services within the last 12 months indicating the new building’s percentage performance above current Building Code requirements at time of application (minimum 10% better than Building Code).

- modeled energy performance consistent with the requirements of Montgomery County Code, Section 52-103B.

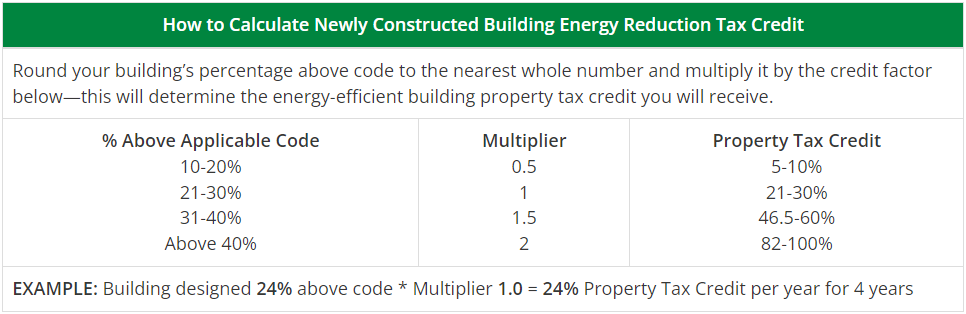

Tier 1 Credit for Newly Constructed Buildings

To receive the 1st tier credit: eligible newly constructed building owners must achieve a minimum 10% energy efficiency performance above Montgomery County’s current building code requirement. This tax credit allows one (1) application for a single property.

Buildings located in Equity Emphasis Areas receive an additional 10% credit.

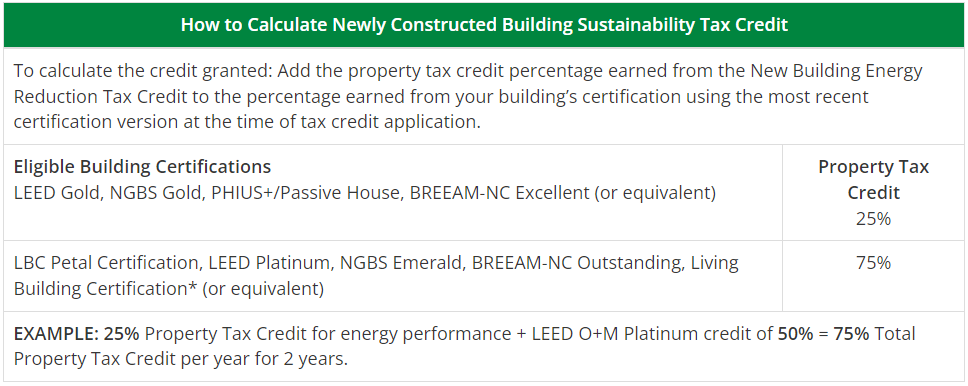

Tier 2 Credit for Newly Constructed Buildings

Once the 1st tier credit is met, building owners can apply for an additional tax credit for four years, the Building Sustainability Tax Credit, by receiving a LEED, BREEAM, or equivalent (robust, third-party certification systems that strive for net-zero buildings) energy efficiency certification. If the 1st tier and 2nd tier are achieved, the two credits will be aggregated, but cannot exceed 100% per year.